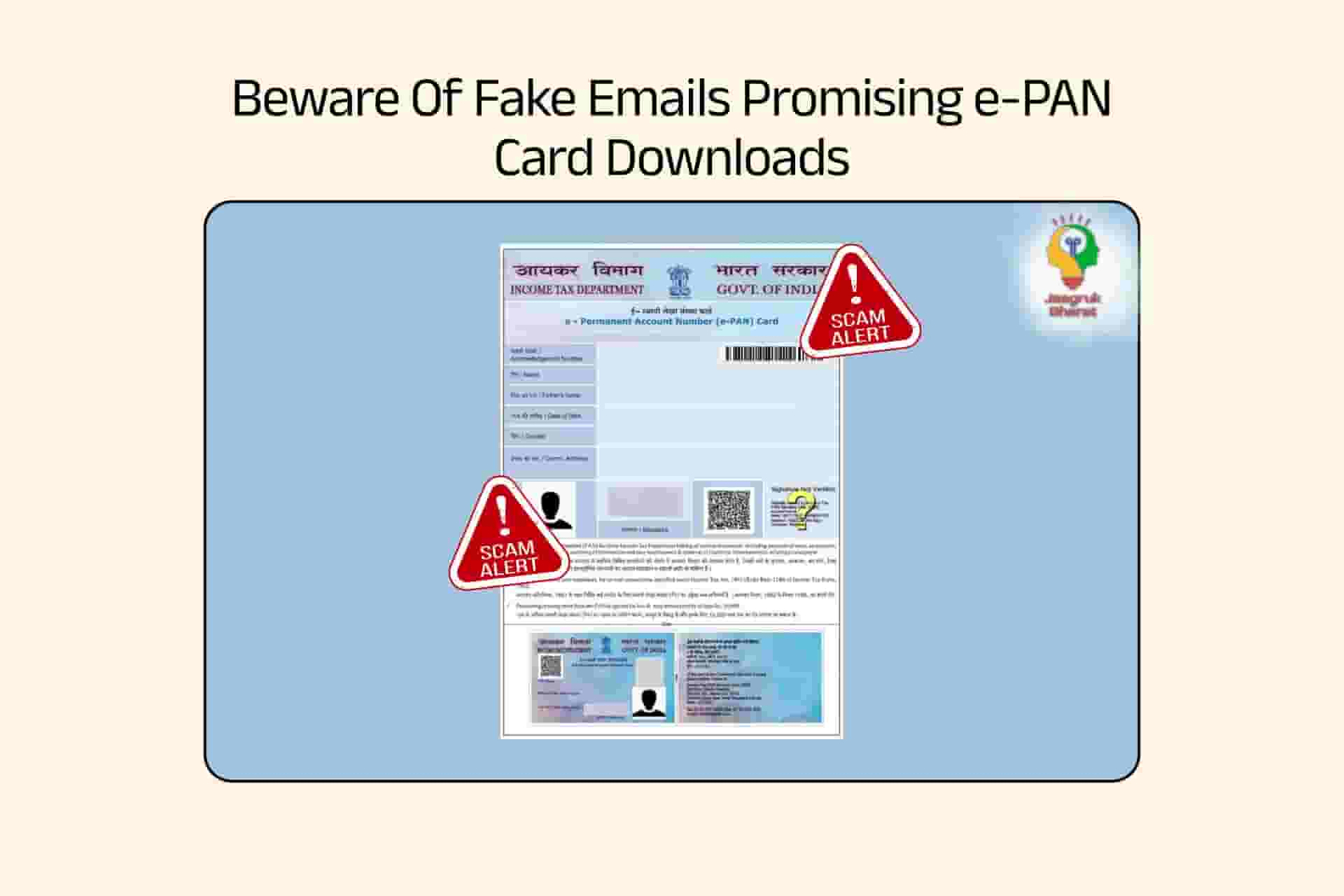

Beware Of Fake Emails Promising e-PAN Card Downloads—Protect Yourself From Scams

Updated: 13-10-2025 at 7:35 AM

1k

Have you received an email asking you to download your e-PAN card? Scammers are now targeting individuals by sending fake emails claiming to be from the Income Tax Department. Irrespective of the means used, these messages are intended to deceive users into providing private information or clicking on phishing URLs.

In this article, you’ll learn about how to recognise phishing emails and scams, the purpose of the government’s PAN 2.0 programme, and some measures to protect yourself.

Fake e-PAN Emails: What You Need to Know

The Press Information Bureau (PIB) Fact Check recently flagged a phishing scam involving fake emails about e-PAN card downloads. These emails appear to be from the Income Tax Department, claiming users need to download their e-PAN cards under the new PAN 2.0 initiative.

In a warning shared on X (formerly Twitter), PIB Fact Check stated:

“Have you also received an email asking you to download an e-PAN Card? PIBFactCheck: This is a fake email. Never reply to calls, texts, emails, or links requesting sensitive or financial information.”

Scammers use these emails to lure victims into revealing confidential details like passwords, bank account numbers, and credit card information.

Read More: Be Cautious Against PAN 2.0 Scams

What Is PAN 2.0?

PAN 2.0 has a sense of much more aesthetics and this was introduced by the Income Tax Department of India. These enhanced e-PAN cards come with a QR code to encode the card for better security against fraud abuse and robbery. However, current holders of the PAN card are not required to upgrade.

What Is Phishing?

Phishing is a cybercrime where fraudsters disguise themselves as trusted entities to steal sensitive information. According to the Income Tax website:

“Phishing is the process of attempting to acquire sensitive information such as usernames, passwords, and credit card details by masquerading as a trustworthy entity in an electronic communication.”

These scams often involve emails or messages directing users to fake websites designed to mimic legitimate ones, tricking them into entering their details.

How To Stay Safe from Phishing Scams

Phishing scams trick people into sharing personal or financial information through fake emails or messages. Staying cautious and following simple steps can help you avoid falling for these scams. Here’s how to stay safe from phishing:

-

Do Not Reply to Suspicious Emails: Ignore and delete emails claiming to be from the Income Tax Department requesting personal or financial information.

-

Avoid Clicking on Links: Never click on links or attachments in emails from unknown senders. They may contain malicious software or direct you to fake websites.

-

Do Not Share Sensitive Information: Legitimate organisations will never ask for PINs, passwords, or bank account details via email.

-

Use Security Tools: Install and regularly update anti-virus, anti-spyware software, and a firewall to protect your device from malicious software.

-

Verify the Sender: Always cross-check emails claiming to be from the Income Tax Department by contacting their official helpline or website.

Read More: What Income Tax Payers Need To Know About PAN 2.0?

How To Report Phishing Emails

If you receive an email that looks like a phishing attempt, it’s important to report it right away. Reporting helps authorities take action against scammers. Here’s how you can report phishing emails:

-

Forward the Email: Send the email or its URL to webmanager@incometax.gov.in and incident@cert-in.org.in.

-

Provide Internet Headers: Include the email’s header information to help locate the sender.

-

Delete the Email: After reporting, immediately delete the email from your inbox.

Conclusion

Scammers are taking advantage of the modernisation of e-PAN, to cheat people. In such respects it leads to a broader message, individuals can always be more informed and cautious, and they have certain responsibilities toward the society. Always check e-mail messages, and do not give away sensitive data via the Internet. For your safety, be sure to report any suspicious activity to the appropriate authorities.

Join the conversation and stay informed! Visit the Jaagruk Bharat community page here and be part of an active, engaged community.

Frequently Asked Questions

0

0

1k

0

0

1k Views

0

No comments available

Our Company

Home

About

T&C

Privacy Policy

Eula

Disclaimer Policy

Code of Ethics

Contact Us

Careers

Cancellation & Refund Policy

Categories

Women

Insurance

Finance

Tax

Travel

Transport & Infrastructure

Food

Entertainment

Communication

Government ID Cards

E-commerce

Traffic guidelines

Miscellaneous

Housing and Sanitation

Sports

Startup

Environment and Safety

Education

Agriculture

Social cause

Employment

Disclaimer: Jaagruk Bharat is a private organization offering support for documentation and government scheme access. We are not affiliated with any government body. Official services are available on respective government portals. Our goal is to make processes easier and more accessible for citizens.

All Copyrights are reserved by Jaagruk Bharat